Buyer Aid: Try to find a company that offers focused assistance, including entry to proficient specialists who can reply questions about compliance and IRS rules.

Greater Service fees: SDIRAs normally feature larger administrative expenditures in comparison to other IRAs, as particular components of the administrative approach can not be automatic.

Entrust can assist you in paying for alternative investments with the retirement money, and administer the getting and advertising of assets that are generally unavailable by financial institutions and brokerage firms.

The tax benefits are what make SDIRAs attractive For numerous. An SDIRA is often each common or Roth - the account type you decide on will depend mainly on your own investment and tax strategy. Verify with your fiscal advisor or tax advisor in the event you’re unsure which is greatest for yourself.

However there are lots of Gains connected with an SDIRA, it’s not without its have drawbacks. A lot of the prevalent reasons why investors don’t opt for SDIRAs include:

Limited Liquidity: Many of the alternative assets which can be held in an SDIRA, for instance property, private equity, or precious metals, is probably not conveniently liquidated. This can be an issue if you need to entry cash promptly.

No, You can't put money into your own personal organization using a self-directed IRA. The IRS prohibits any transactions among your IRA along with your possess company as you, given that the proprietor, are considered a disqualified individual.

Have the liberty to invest in Just about any sort of asset having a chance profile that fits your investment strategy; including assets that have the probable for a higher amount of return.

A self-directed IRA can be an extremely highly effective investment vehicle, nevertheless it’s not for everyone. Because the indicating goes: with great ability arrives fantastic accountability; and having an SDIRA, that couldn’t be more correct. Continue reading to find read this article out why an SDIRA may well, or may not, be for you.

And because some SDIRAs which include self-directed classic IRAs are subject matter Related Site to demanded least distributions (RMDs), you’ll ought to system in advance in order that you've got adequate liquidity to meet The principles established through the IRS.

Making quite possibly the most of tax-advantaged accounts means that you can preserve a lot more of The cash that you choose to invest and earn. Dependant upon no matter if you choose a conventional self-directed IRA or even a self-directed Roth IRA, you might have the possible for tax-absolutely free or tax-deferred progress, supplied certain conditions are satisfied.

Believe your Mate might be setting go to my blog up the subsequent Facebook or Uber? Using an SDIRA, you could invest in triggers that you think in; and likely enjoy greater returns.

Because of this, they have a tendency not to market self-directed IRAs, which supply the flexibility to take a position inside a broader array of assets.

When you finally’ve located an SDIRA service provider and opened your account, you could be wondering how to actually start off investing. Comprehension equally The foundations that govern SDIRAs, and also ways to fund your account, can help to put the foundation for your way forward for thriving investing.

Ahead of opening an SDIRA, it’s essential to weigh the possible benefits and drawbacks according to your precise fiscal targets and hazard tolerance.

Of course, real estate is among our clients’ most favored investments, in some cases identified as a real estate IRA. Clientele have the choice to take a position in every little thing from rental properties, professional real-estate, undeveloped land, home finance loan notes and even more.

Relocating money from one variety of account to a different type of account, such as shifting cash from the 401(k) to a conventional IRA.

Being an investor, nonetheless, your choices are not restricted to stocks and bonds if you end up picking to self-immediate your retirement accounts. That’s why an SDIRA can rework your portfolio.

Often, the costs related to SDIRAs may be greater plus much more difficult than with a regular IRA. It's because from the enhanced complexity affiliated with administering the account.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Burke Ramsey Then & Now!

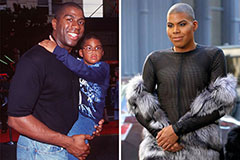

Burke Ramsey Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!